By: James Ocampo, Executive Vice President, Wellfleet Workplace

It’s no secret we’ve become a tech-dependent society. People expect the same digital experiences they’re having as consumers to span all areas of their lives. Interwoven into those interactions, is an expectation of instant gratification. Unfortunately, what we’re seeing in the voluntary workplace benefits market is an industry that hasn’t kept up with consumer expectations.

The anchor of legacy systems

A major contributor to this limitation is that voluntary benefits carriers continue to use multiple legacy systems, or systems that are built on dated technology. Some utilize five to 10 or more different systems to handle quoting, administration, billing and claims. This is problematic because these systems weren’t designed to talk to each other, let alone external platforms. Such poor integration means data is input multiple times, leading to errors.

Compounding these issues is that updating these systems is a massive undertaking and expense. So, carriers tend to “patch” systems, rather than replace. These patchworked systems have major downstream impacts across stakeholders.

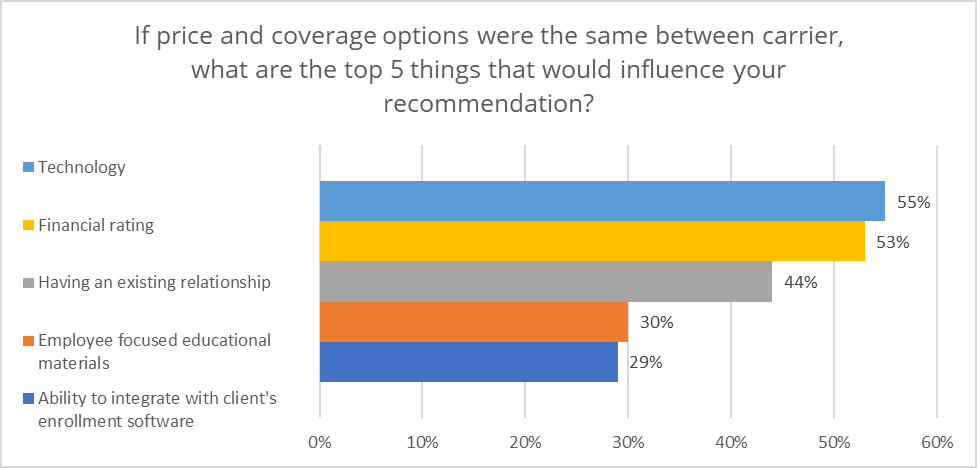

In fact, according to the 2022 Wellfleet Workplace Benefit Broker Survey, if price and coverage options were the same between carriers, carrier technology would be the most important factor a broker would consider when making their recommendation to a client.

Further, as consumers experience unexpected accidents, critical illnesses, and hospitalizations, the architecture of many current systems creates a frustrating and difficult-to-navigate claims process.

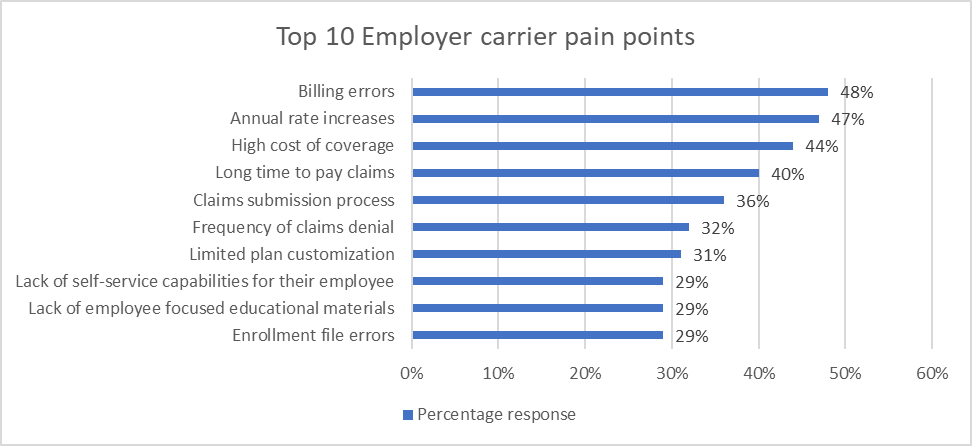

Highlighting this, our 2022 Benefit Broker Survey found that a long time to pay claims and the claims submission process are two of the top five pain points clients experience with their carrier partners: 40% and 36% respectively.

Technology & service

Wellfleet entered the workplace market because of the opportunity to help brokers and their clients do things differently. This would start with the need to exceed client expectations on the technology and service fronts. And to do that, the entire benefits experience would need to be overhauled across the value stream for all our customers, from brokers and clients to technology partners and employees.

It’s important to note that before we became part of the Berkshire Hathaway family of insurance companies, we were a service administrator to many of the carriers we compete with today. So, service is at the heart of what Wellfleet does. This background, our ambition and Berkshire’s A++ (superior) financial strength*, meant we were uniquely positioned to help modernize the delivery of workplace benefit solutions via Lighthouse, our intuitive and highly-flexible, cloud-based benefits platform.

Strategy & the vision for change

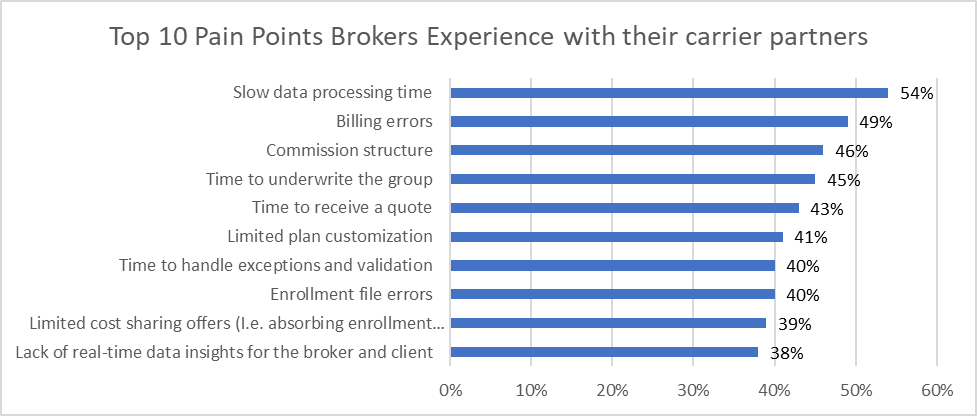

We’ve spent a lot of time understanding the major pain points of each of our customers, including surveying brokers to better understand common carrier and technological challenges. What we’ve heard is that brokers are frustrated with carriers’ complicated commission structures, quoting times, accuracy and flexibility, and the inability to process data in a timely manner.

Now, with employer groups, their carrier pain points center around struggles with billing errors, annual rate increases, overall cost of coverage and claims.

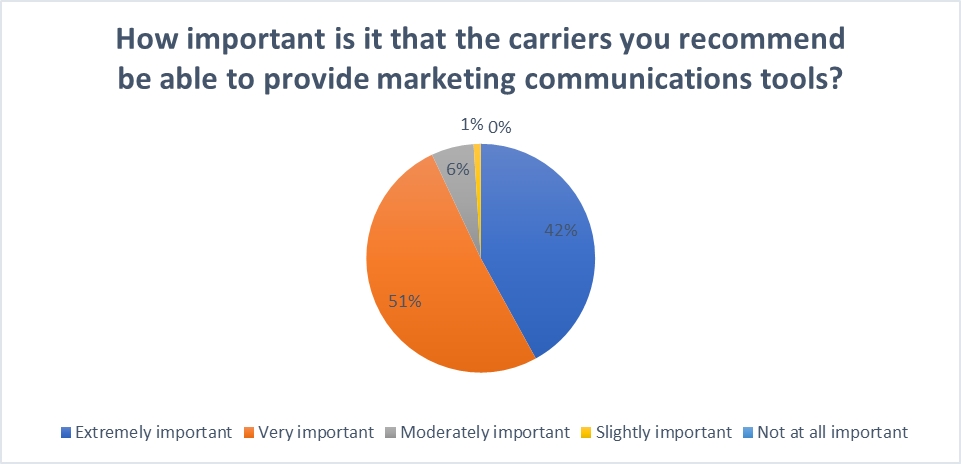

What’s more, is that employees—our true end-users—don’t always understand their benefits. They can feel overwhelmed by claims paperwork and about how quickly they’ll be paid. This is no doubt why 93% of benefits brokers feel it is extremely, to very important for a carrier to provide educational materials to employees in order to be considered for recommendation to their clients. In fact, not one respondent reported this as not at all important.

Digitally enhancing the customer experience

Understanding the struggles of our stakeholders, we dug into the technology needed to support a better experience. For that, Wellfleet partnered with a team of innovators at EIS to leverage their continuously-updated, cloud-based platform, to build Lighthouse.

Lighthouse, powered by EIS, enables us to craft highly customizable plan designs that complement clients’ core benefit offerings. Further, it allows us to easily connect and exchange data with each client’s chosen HR technology platform.

A key feature of Lighthouse is our ability to take clients’ enrollment data in the preferred file structure, then validate and process it in days or even hours. For most carriers, this is a tedious step that typically spans weeks to months.

Lighthouse also acts as a single source of truth, which means we aren’t re-entering data across rating, proposal generation, billing and claims steps. It also allows us to complete customer-specific setups at the time of quote, and to stand up the foundation of the associated billing and claims features.

In addition, Lighthouse powers our intuitive, events-based claims-handling. So, when a Wellfleet customer submits a claim, we reference all their eligible policies. Let’s say you submit an accident claim for a broken leg. We’re going to pay a fracture benefit, but we will also seek to identify other benefits the claimant is eligible to receive.

The reason we all work in this business is because we believe in the importance of financial protection products. Connecting to those products and using them shouldn’t be a hassle. In building Lighthouse, we are showing customers that you can have the same type of personalized, technology-forward experiences you’ve come to expect in other areas of your life, with workplace benefits too.

For more information on how Wellfleet Workplace is helping improve the voluntary benefits experience, visit WellfleetWorkplace.com.

______________________________________________________________________________________________

*Rating effective as of July 14, 2022. For the latest ratings, visit ambest.com.

Wellfleet is the marketing name used to refer to the insurance and administrative operations of Wellfleet Insurance Company, Wellfleet New York Insurance Company, and Wellfleet Group, LLC. All insurance products are administered or managed by Wellfleet Group, LLC. Product availability is based upon business and/or regulatory approval and may differ among companies.

©2022 Wellfleet Group, LLC. All Rights Reserved

About the Author

As EVP of Wellfleet Workplace, James Ocampo focuses on driving strategy, execution and providing financial leadership for the division. He holds an undergraduate degree from Boston College, and an MBA in Finance and Strategy from The Wharton School at the University of Pennsylvania.

Wellfleet Workplace

Wellfleet is a Berkshire Hathaway company focused on protecting people against risk throughout every stage of life — from birth to grade school, college, the workplace and beyond. Wellfleet’s Workplace division delivers customizable, digitally-forward benefit solutions through a suite of employee benefit products, including: Accident, Critical Illness, Hospital Indemnity and Short-Term Disability Income insurance. For more information, visit www.wellfleetinsurance.com